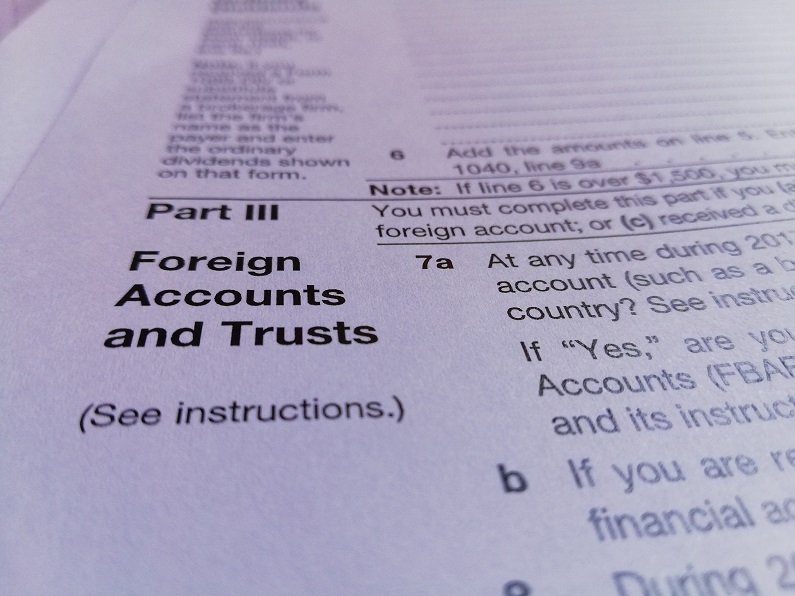

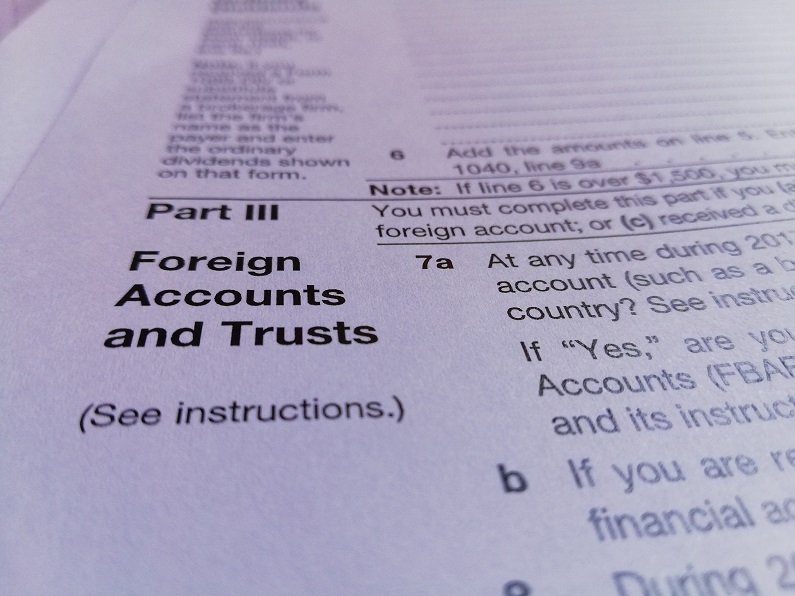

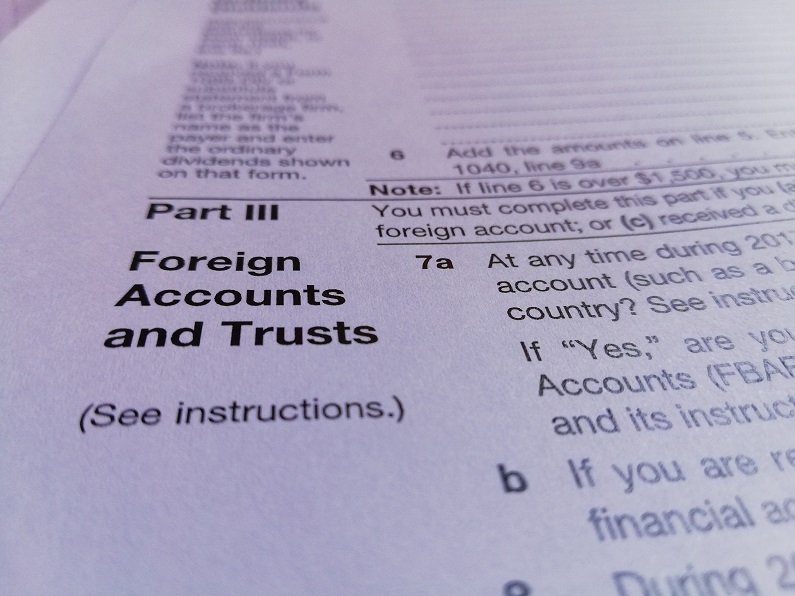

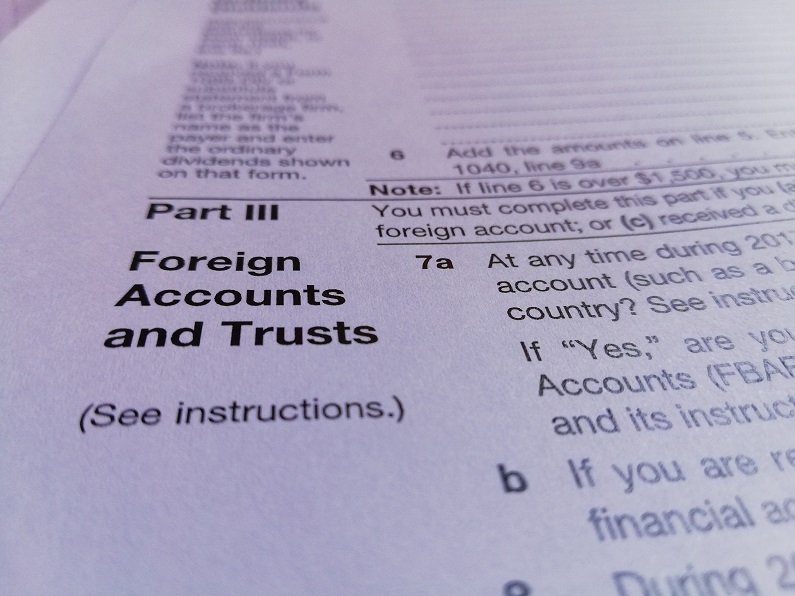

Whilst the first filing deadline for individual United States income tax returns has now passed, the Report of Foreign Bank Accounts (FBAR) is due for filing by 30 June and can now be filed online. The report, Form TD F 90-22.1, (Form) is filed separately to Form 1040...

Now that the first and major filing deadline for 2012 of 15 April has passed, taxpayers may be receiving notices from the IRS. In contrast to the New Zealand system, through which taxpayers receive a Return Acknowledgement upon filing tax returns, the IRS does not...

Any taxpayer with Federal tax to pay can pay the IRS by electronic transfer of funds upon obtaining a PIN number. Although we are still three months off the due date for 2012 taxes, a PIN needs to be obtained in advance and in time for the due date of 15 April and so...

We’ve just filed our first Extension of Time (EOT) to extend the due date for filing a 2011 US tax return to 15 October 2012. We are now using IRS e-file to file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return....

The Internal Revenue Service has registered NZ US Tax Specialists as e-file providers. Shortly we will be electronically filing certain 2011 United States tax returns enabling faster processing by the Internal Revenue Service. In addition, we will be able to e-file...

Whilst the first filing deadline for individual United States income tax returns has now passed, the Report of Foreign Bank Accounts (FBAR) is due for filing by 30 June and can now be filed online. The report, Form TD F 90-22.1, (Form) is filed separately to Form 1040...

Now that the first and major filing deadline for 2012 of 15 April has passed, taxpayers may be receiving notices from the IRS. In contrast to the New Zealand system, through which taxpayers receive a Return Acknowledgement upon filing tax returns, the IRS does not...

Any taxpayer with Federal tax to pay can pay the IRS by electronic transfer of funds upon obtaining a PIN number. Although we are still three months off the due date for 2012 taxes, a PIN needs to be obtained in advance and in time for the due date of 15 April and so...

We’ve just filed our first Extension of Time (EOT) to extend the due date for filing a 2011 US tax return to 15 October 2012. We are now using IRS e-file to file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return....

The Internal Revenue Service has registered NZ US Tax Specialists as e-file providers. Shortly we will be electronically filing certain 2011 United States tax returns enabling faster processing by the Internal Revenue Service. In addition, we will be able to e-file...